When the government needs to borrow, the U.S. Treasury to “members of the public” (to some extent to individuals, but mostly to financial firms, in the United States and abroad) and to the central banks of other countries.

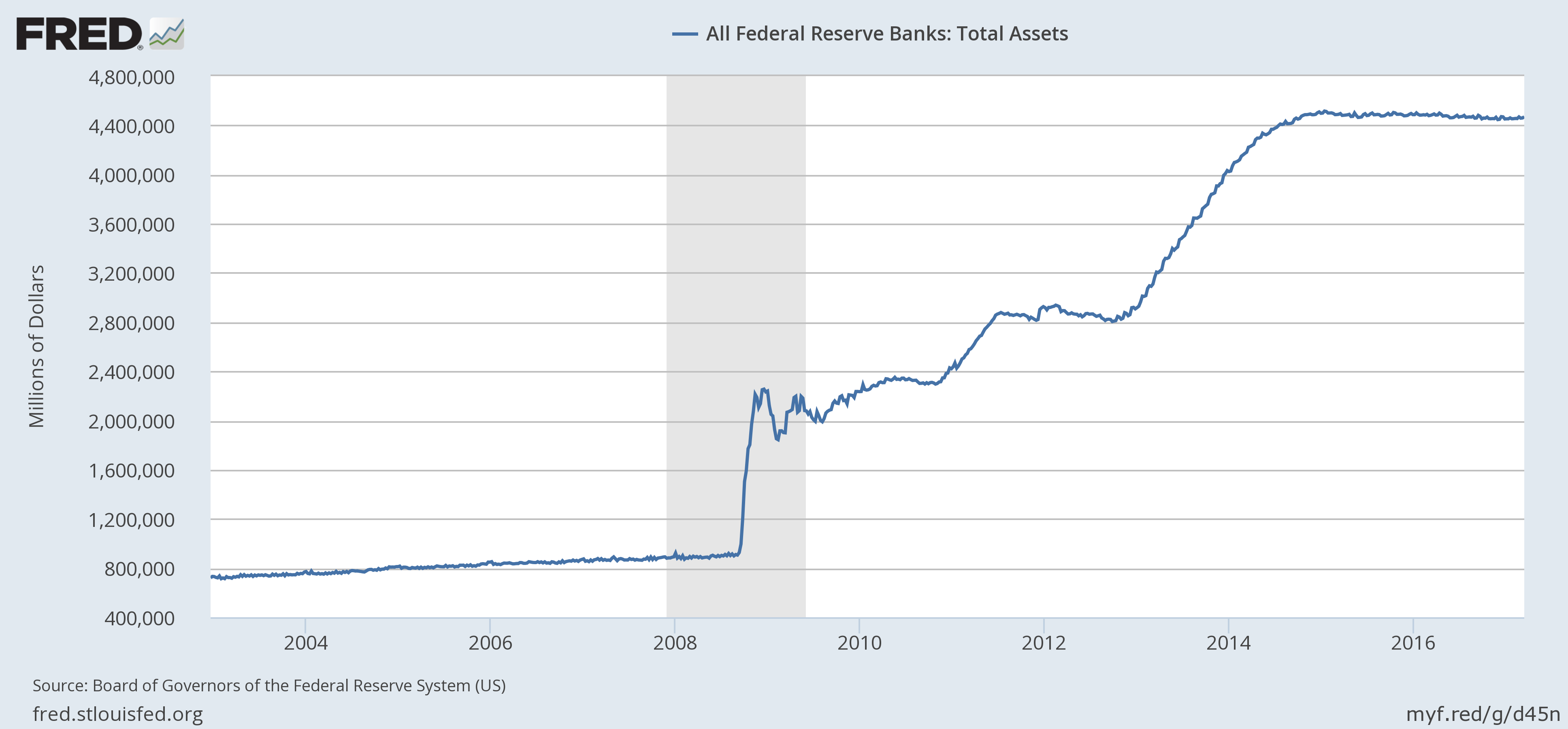

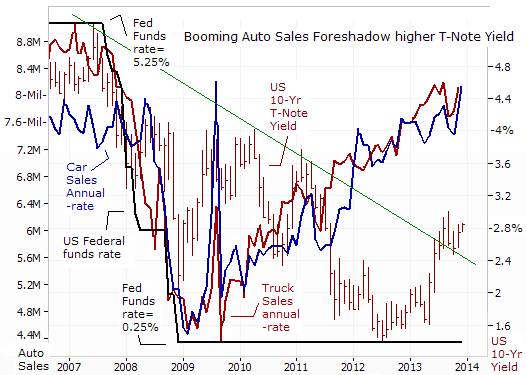

No, the Fed buys bonds previously sold by the U.S. When the Fed buys government bonds, does that just mean paper is shuffling back and forth between one part of the government and another? Usually, the Fed buys and sells short-term government bonds in order to change a very short-term interest rate called the “federal funds rate.” Now, the Fed is buying and selling longer-term government bonds, with the aim of influencing longer-term rates. (We can think of this as the Fed increasing the money supply, which makes money more plentiful and drives down the price of borrowing.) This purchase increases the price of bonds and lowers the interest rate on these bonds. This makes money less plentiful and drives up the price of borrowing.) When Fed policymakers decide they want to lower interest rates, the Fed buys government bonds. (We can also think of this as the Fed reducing the money supply. This sale reduces the price of bonds and raises the interest rate on these bonds. When Fed policymakers decide that they want to raise interest rates, the Fed sells government bonds. It decides whether to increase or decrease interest rates depending on whether it aims to pump up or rein in overall demand for goods and services.

The main way that the Fed influences interest rates is by buying and selling government bonds. This is the central monetary-policy making authority for the United States. When we hear about government policies designed to change the money supply or influence interest rates (monetary policy), we are talking about the role of the Federal Reserve (or “the Fed”). Let’s start with how the government influences interest rates. Don’t banks decide what interest rates to charge-like on business loans, home mortgages, car loans, or whatever? How would the government force banks to charge the interest rates that the government wants? And what does buying bonds have to do with it anyway? (While the Federal Reserve is buying both government and private bonds, here we will focus just on purchases of government bonds.) The reduction in long-term interest rates, in turn, is meant to stimulate investment and other forms of spending. What’s that all about?īasically, the government is purchasing long-term bonds in order to push down long-term interest rates. I heard that the government is now buying long-term bonds. Why is the Government Buying Long-Term Bonds?

0 kommentar(er)

0 kommentar(er)